Switches Aligned, Route Clear! 🚆

For much of their history, railways were a symbol of the state. They were operated by national governments, funded with public money, and shielded from competition. The logic was simple: rail was essential, expensive, and strategic — and therefore best managed as a state-controlled monopoly.

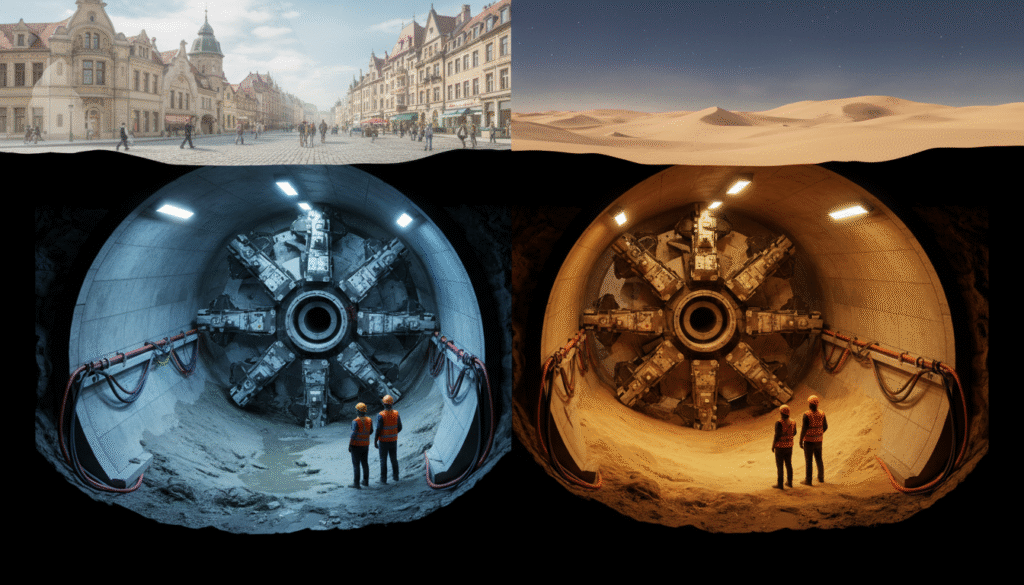

But over the last few decades, this model has been steadily replaced by a new one. Across Europe, Asia, and parts of the Americas, railways have opened up to competition, private investment, and cross-border operators. Today, the train you board might still run on public tracks — but it could be operated by a private company, priced dynamically, and managed with tools borrowed from the airline industry.

So how did we get here? And what does this mean for the future of rail?

From Monopolies to Market Reform

Throughout the 19th and much of the 20th century, railways were seen as natural monopolies. It made sense at the time: building tracks and running trains required huge upfront investment, and governments wanted to ensure coverage even in remote or unprofitable regions.

Under this model, most countries had a single, vertically integrated operator in charge of both infrastructure (the tracks, stations, and signals) and operations (passenger and freight services). Prices were fixed. Competition was minimal. And while this ensured a degree of control, it also led to inefficiencies, rising costs, and stagnant service quality.

By the 1970s and 80s, with declining market share and growing financial losses, many governments began to ask the same question: Can railways be modernized through competition?

The Reform Era: Breaking the System Open

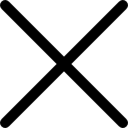

That question sparked a wave of reforms. The first step was often “vertical separation” — splitting the management of infrastructure from train operations.

Instead of one national company doing everything, countries created rail infrastructure managers (like Network Rail in the UK or RFI in Italy), while allowing multiple operators to run trains on those same tracks — provided they paid access fees.

At the same time, private companies were invited in. Some were given franchises to run regional or national services. Others began offering open-access services on competitive routes, often with more flexible pricing, newer trains, and customer-focused innovations.

It was a new model for an old industry — one where efficiency was driven not by public planning, but by market incentives.

The European Story: A Case in Liberalization

Nowhere has this transformation been more structured — or more ambitious — than in the European Union.

Starting in the early 2000s, the EU launched a series of “Railway Packages” — legislative reforms aimed at building a single European railway market. These packages gradually opened national networks to foreign operators, set common rules for safety and interoperability, and guaranteed non-discriminatory access to infrastructure.

The idea was clear: passengers should be able to travel across borders with ease, just like on highways or in the air. Operators should compete fairly, regardless of nationality. And innovation should be encouraged, not blocked by bureaucracy.

The result? Trains like Italo in Italy, RegioJet in Central Europe, and FlixTrain in Germany — all run by private companies competing with legacy national railways.

Benefits and Bumps in the Track

So, has railway liberalization worked?

In many ways, yes.

Passengers now enjoy more choice, better service, and often lower prices. Trains are cleaner, faster, and more connected. Technology has improved — from online booking and real-time updates to high-speed rail and alternative energy trains.

And yet, the transition hasn’t been smooth everywhere.

Some countries, like Germany and Sweden, embraced competition early. Others, like France, have been slower to open up — often citing concerns over labor rights or national cohesion.

Moreover, infrastructure funding remains a public responsibility. While operators compete on services, it’s still governments that must maintain the tracks, upgrade signals, and build new stations. Without continued public investment, liberalization alone can’t deliver long-term improvements.

And in some places, fragmentation of services has caused confusion: different operators, different ticketing systems, and inconsistent timetables can make travel more complicated for passengers, not less.

The Road Ahead: Competition Meets Coordination

Despite these challenges, liberalization is moving forward — and the next frontier may be high-speed international corridors.

Private players are now eyeing long-distance routes like Paris–Berlin, Milan–Barcelona, or Amsterdam–Copenhagen, promising sleek trains, better service, and new business models.

At the same time, governments and regulators are working to balance open competition with public service obligations — ensuring that rural routes, night trains, and low-income passengers aren’t left behind.

In the years ahead, new technologies like hydrogen propulsion, driverless trains, and AI-based operations will test the flexibility of both old and new models. And the big question will remain: How do we keep railways efficient, green, and fair — without going back to monopolies or letting the market run unchecked?

Conclusion: From State Control to Shared Innovation

The story of railway liberalization is far from over. But one thing is clear: the age of the monolithic national railway is behind us.

In its place, a more open, competitive, and dynamic railway sector is taking shape — one that combines public infrastructure with private service delivery, national planning with international access, and tradition with innovation.

For passengers, the impact is already visible: more routes, more options, better trains.

For the industry, the journey is just beginning.

And at Beyond Tracks, we’ll be here to follow it — station by station, reform by reform.

Sources:

-

European Commission – Railway Market Monitoring Reports (RMMS), 2021–2023

-

European Union Agency for Railways (ERA) – EU Rail System Overview and Interoperability Framework

-

OECD – International Transport Forum (ITF) – “Liberalisation and Competition in Railways” Reports

-

Japan MLIT – History and Evaluation of Japan National Railways Privatization

-

UK Department for Transport – Rail Reform and Franchising Analysis

-

CER (Community of European Railway and Infrastructure Companies) – Railway Packages and Market Opening Reports